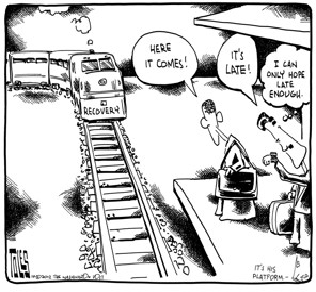

Jared Bernstein had a great piece today about how the recovery is increasingly doing better than Romney needs it to. Yes I nicked that photo above from him-it's just so perfect though. There are some who try to claim that Americans will grade the President not on the better numbers of the past two months but rather a time lag of 3 months or so.

This is the most charitable view for Romney, but it doesn't sound so convincing. For one thing the polls seem to show that the electorate's views on the economy and the President's performance are far from set in stone, but have been volatile and subject to change. Romney had the better of the poll numbers on the economy for the better part of a year-especially after the slowdown in the 2nd quarter this year.

For all that he was unable to capitalize on it. as he never led meaningfully at any point. Since the Democrat's convention Obama was actually able to pull roughly even with Romney on the economy-prior to it Romney had about a 6 point lead on the economy. Indeed, what was particularly striking about the ABC/Washington Post poll is that the President actually had a 5 point lead on the economy.

While most Americans still say the economy is going in the wrong direction the number is now well under 60% with those saying the right track coming in over 40%. Until the convention, those who said the wrong track were almost 70% and those who said the right track were under 30%.

Economic confidence is up too which suggests that Americans are aware it's improving. And then there were the Gallup numbers yesterday. Gallup now says that the unemployment rate is actually down to 7.3%. The big numbers are the Bureau of Labor Statistics nonfarm payroll number-which will come in just before the election. Still Gallup had been right last month when it had said the unemployment rate was beneath 8%-so BLS very often ends up matching Gallup.

So it's conceivable that on Friday, October 2-just over two weeks now-Americans will hear that the unemployment rate is now down to only 7.3%. This number would be important too as we always hear the media belaboring the point of how no President since the postwar era has been elected with an unemployment rate above 7.4%. Who would have thought a few months ago that the number might actually get there before the election on November, 6?

While Romney and friends have argued that the President should be blamed for a slow recovery as Reagan got it done so much faster, it's beginning to look like the unemployment rate will do very much what it did in 1984 for Reagan-it got down to 7.4% only very late.

Of course, we're putting to one side the fact that recoveries from housing busts are always much tougher so the President's achievement would in some way be more impressive.

As Bernstein points out, Romney's shrill calls that the sky if falling are in danger of coming to seem out of touch with reality:

"The challenger will always try to talk down the economy. Even back in 1996, when jobs, growth, and even middle-class incomes were really taking off, candidate Bob Dole was trying to convince everyone that things were bad and getting worse."

"It is, of course, a much closer call now, but still, I doubt that Gov. Romney's assault on the recovery in Tuesday night's debate resonated as much as he'd like it to. And I think Greg Sargent is right here: team Obama should continue to push back on this point, particularly re: housing, which didn't come up at all Tuesday night."

"All three major home price indices are up and the 30-year mortgage rate is at an all-time low. This combination of home price appreciation and low rates has allowed more homeowners to refinance, lowering average annual mortgage payments by around $2,200. Housing starts got a big pop Wednesday AM, hitting their strongest stride since 2008, and while the monthly data are volatile, there are signs that the inventory overhang in housing is much diminished."

"Last month, auto sales hit a four year high, with annualized sales just below 15 million, the highest sales count since March 2008. Since GM and Chrysler have emerged from their government-structured bankruptcy, the industry's added almost 250,000 jobs."

"Unemployment, 10 percent three years ago, is 7.8 percent -- still too high, but moving in the right direction. Mitt's got a point re: the depressed labor force participation rate, but he's all stuff and malarkey if he really thinks that explains all, or even half, of the progress on unemployment."

"Employment growth accelerated notably in the third quarter of the year relative to the second (see first figure here). Still, despite the momentum, the jobless rate is too high to boost workers' bargaining power and you can see that in paychecks."

"But I suspect there's NCD -- nontrivial cognitive dissonance -- between Romney's portrait of the economy and many people's experience of it, especially around some of the more tangible aspects like housing values and mortgage rates. When Sen. Dole tried to convince people otherwise back in 1996, it was a huge loser for him. The timing isn't nearly as supportive for the president, as he's faced down a much deeper and more intractable recession, with the opposite of cooperation from Congress. But the truth is that things are slowly getting better and Romney's claims to the contrary may be drowned out by this reality."

http://www.huffingtonpost.com/jared-bernstein/obama-economy-recovery_b_1975221.html

Yes. Romney's NCD problem! It's got a nice ring up there with it being a bunch of stuff and just flat out malarkey. And of course, a binderful of women.

No comments:

Post a Comment