I looked at Simon Wren-Lewis' post arguing for RE yesterday.

http://diaryofarepublicanhater.blogspot.com/2013/11/simon-wren-lewis-makes-case-for.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+DiaryOfARepublicanHater+%28Diary+of+a+Republican+Hater%29

In that post I had quoted Nick Rowe as well who seemed to maybe be saying something a little different from WL on the question of AE. However, in the comments section, Nick made it clear that he basically agrees with WL-adaptive expectations assumes 'people are stupid.'

"There are many worlds in which adaptive expectations would be rational. BUT, the key insight of Rational Expectations was that, even in those worlds, the parameter B will not be a constant. B will depend on how X(t) actually varies in the world you live in. For example, if X(t) is a random walk, a rational person would have B=1. And if X(t) is white noise, a rational person will have B=0. And so on. That was an important insight."

"The blue curve is inflation expected by ordinary people from the Michigan Survey, the red curve is cpi inflation in the yer till the date of the survey and the green line is core inflation (CPI minus food and energy). It seems to me that survey expected inflation is equal to CPI inflation except when CPI infation is extraordinarily different from core inflation because of a recent Iraqi invasion of Iran or theh 2008 collapse of demand for, among other things, petroleum. This simple ad hoc model CPI or core if very different fits the data rather well. I would say its empricial success is vastly greater than the empirical success of any micro founded macro model..I note that my model is much more naive than the paleo-Keynesian approach. Adaptive expectations are a weighted sum of the old expected inflation and lagged actual inflation. They smooth off peaks as in 1980 and early 2009. The blue curve looks like the red curve smoothed is a pretty good summary of data all of which was collected *after* rational expectations assumption was declared the winner of the debate."

"There is another anomaly. In recent years Michigan survey forecast inflation is persistently higher than actual inflation. At the same time the general public’s estimates of achieved inflation are higher than official calculations. The rational expectations assumption has very strong implications for statements about data available at the time the statement was made. These implications are totally rejected by the data.

- See more at: http://angrybearblog.com/2013/11/rational-vs-adaptive-exectations.html#comments

"Isn;t adaptive expectations a property of the *aggregate*? Assuming AE assumes nothing about the behaviour of individuals. So the claim that AE assumes agents are stupid, is stupid. Is the fallacy of composition so deeply entrenched in macroeconomists’ thinking that they are unable to even imagine that the individual and aggregate can behave in ways that are very different? It is entirely possible that some individuals do indeed have ‘adaptive expectations’, but it is not necessary. AE is a simple heuristic for capturing the inertia in the behaviour of aggregates . How the behaviour of diverse agents, heterogeneous along multiple dimensions, aggregates to inertia in the aggregate is an important but separate question."

http://diaryofarepublicanhater.blogspot.com/2013/11/simon-wren-lewis-makes-case-for.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+DiaryOfARepublicanHater+%28Diary+of+a+Republican+Hater%29

In that post I had quoted Nick Rowe as well who seemed to maybe be saying something a little different from WL on the question of AE. However, in the comments section, Nick made it clear that he basically agrees with WL-adaptive expectations assumes 'people are stupid.'

"There are many worlds in which adaptive expectations would be rational. BUT, the key insight of Rational Expectations was that, even in those worlds, the parameter B will not be a constant. B will depend on how X(t) actually varies in the world you live in. For example, if X(t) is a random walk, a rational person would have B=1. And if X(t) is white noise, a rational person will have B=0. And so on. That was an important insight."

"I'm (just) old enough to remember Adaptive Expectations in the days. Rational Expectations. And we really did assume people were totally stupid; we assumed (without really realising this) that people could be surprised on the upside again and again and again, while never adjusting their rule of thumb to stop making those obvious repeated mistakes. Some economists do go a bit overboard with RE, in ignoring the problems people face in figuring out the world has changed, especially if the world is complicated. But we were way worse in the olden days."

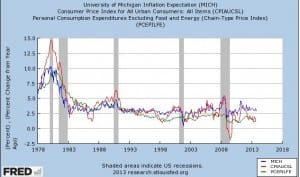

Waldman over at Angry Bear has his own response to WL. He argues that the RE approach certainly gave policymakers the wrong implications of the effect of the sharp disinflation of the early 80s. He then provides an 'ad hoc CPI model' which seems to show that AE does quite well. I'll cut and paste the chart for you as I have a litle trouble reading it-it's too small.

"I ask Professor Wren-Lewis how often he looks at a graph like the one below (made at FRED). I am asking for information and I hope to get an answer.

"The blue curve is inflation expected by ordinary people from the Michigan Survey, the red curve is cpi inflation in the yer till the date of the survey and the green line is core inflation (CPI minus food and energy). It seems to me that survey expected inflation is equal to CPI inflation except when CPI infation is extraordinarily different from core inflation because of a recent Iraqi invasion of Iran or theh 2008 collapse of demand for, among other things, petroleum. This simple ad hoc model CPI or core if very different fits the data rather well. I would say its empricial success is vastly greater than the empirical success of any micro founded macro model..I note that my model is much more naive than the paleo-Keynesian approach. Adaptive expectations are a weighted sum of the old expected inflation and lagged actual inflation. They smooth off peaks as in 1980 and early 2009. The blue curve looks like the red curve smoothed is a pretty good summary of data all of which was collected *after* rational expectations assumption was declared the winner of the debate."

"There is another anomaly. In recent years Michigan survey forecast inflation is persistently higher than actual inflation. At the same time the general public’s estimates of achieved inflation are higher than official calculations. The rational expectations assumption has very strong implications for statements about data available at the time the statement was made. These implications are totally rejected by the data.

- See more at: http://angrybearblog.com/2013/11/rational-vs-adaptive-exectations.html#comments

Waldman argues that it's reasonable to assume AE for developed countries with the exception of those experiencing hyperinflation.

A commentator at AB makes a good point as well:

"Here’s a question I asked Wren-Lewis but didn’t get a response. Either my question was idiotic or there really isn’t a good answer."

"Isn;t adaptive expectations a property of the *aggregate*? Assuming AE assumes nothing about the behaviour of individuals. So the claim that AE assumes agents are stupid, is stupid. Is the fallacy of composition so deeply entrenched in macroeconomists’ thinking that they are unable to even imagine that the individual and aggregate can behave in ways that are very different? It is entirely possible that some individuals do indeed have ‘adaptive expectations’, but it is not necessary. AE is a simple heuristic for capturing the inertia in the behaviour of aggregates . How the behaviour of diverse agents, heterogeneous along multiple dimensions, aggregates to inertia in the aggregate is an important but separate question."

As to the issue of 'idiotic questions' it's kind of par for the course that establishment Neoclassical economists love to play the Sumner care that 'you're too ignorant to have a conversation with.' WL engages in it too.

Herman also references the hyperinflation paper of Sargent where he looked at AE vs. RE and RE seemed not to do well-yet this was not fatal to RE-quite the opposite.

HT: Nanute

P.S. I hope Waldman gets an answer too but we know that WL has some skepticism about the fitness of heterodox economists to have a conversation with the NCers-though he is certainly much more open minded and friendly than Sumner who's pompous attitude is almost a caricature

P.S.S. We can see the fault lines of the Macro debates in several different ways. We can conceptualize it as heterodox vs. orthodox-ie, Neoclassical-economics. We can see it as Monetarism vs. Keynesianism-with Sumner's current brand of Market Monetarism as the latest salvo in a longer debate.

The trouble with the Monetarist vs. Keynesian conception is that there is a good deal of overlap between 'Keynesian' and orthodox econ. There is heterodox Keynesianism and there's orthodox Keynesianism-Joan Robinson's 'bastardized Keynesianism.'

I think overall, the true fault lines are Keynesian economics vs. pre-Keynesian economics. Current Neoclassical New Keynesian economics is a kind of amalgamation of the two-it accepts Keynesian economics but dilutes this by insisting that all Keynesian analysis must justify itself in front of a pre Keynesian peer review-this peer review is called microfoundations.

So in principle I disagree with RE because it's pre Keynesian economics-it claims that we can only analyze the macroeconomy with reference to explaining it in microeconomic terms. It's still methodological individualism after all these years and, ergo, it's pre-Keynesian.

No comments:

Post a Comment