Murphy never gives up trying to have a gotcha moment, though so often he misfires when he tries this:

"Brad DeLong has this habit where he makes it look as if he’s walked through several different strands of evidence, and they all come down squarely on the position he agreed with at the start of his investigation–even though some of the evidence obviously cuts the other way. It’s like we’re arguing over whether the Beatles ever released goofy songs, and he says, “I have considered John, Paul, George, and Ringo, and see no reason to support your wild accusation.”

http://consultingbyrpm.com/blog/2013/08/delong-sees-nothing-in-the-investment-data-that-would-slow-capacity-growth.html

From the start this analogy underscores the whole problem with Murphy. The question of whether the Beatles every did any goofy songs is a matter of opinion anyway-bringing up is kind of besides the point. One problem with many of Murphy's quibbles is that they're so often of the 'C'mon, of course the Beatles released goofy songs' nature. The answer is totally subjective and the question isn't too important.

Asking such questions is part of Murphy's stock and trade-no quibble is too minor. Presumably Krugman and Delong can take this as a compliment-after all, if he had anything on them he'd lead with that.

But the most egregious claim above is that there’s nothing “in the level of investment…to suggest that the path of growth of U.S. sustainable potential GDP is materially lower today than was believed back in 2007.”

http://delong.typepad.com/sdj/2013/08/any-explanation-for-this-other-than-that-robert-murphy-simply-doesnt-do-his-homework.html

Krugman gets in a good whack at Murphy too:

"But it’s actually much worse than even Brad seems to realize. The potential output series he’s using comes from the Congressional Budget Office, whichdescribes its method (pdf):

http://krugman.blogs.nytimes.com/2013/08/26/news-flash-the-cbo-isnt-stupid/?_r=0

More generally, it seems to me that the argument 'the supply side did it' in explaining this long recession is another case of the futility of supply side arguments in this day and age With how much conservative economists like Murphy and the Republican party spend worrying over the supply side which is always on the verge of contraction according to them, what isn't realized is how much ss theory is a 19th century idea of how the economy grows.

The idea that there is not enough physical capital is very 19th century, recalling a time when the railroads was America's main industry. In that time, the idea that we are constrained by a lack of physical capital least seemed highly plausible. By the end of the century, there was a glut in savings which exploded in the first big U.S. corporate merger wave.

The rise of the modern stock market was due to the fact that there was now a lot more money than than just that needed for investment in physical capital. This was the dawn of the modern financial system and it was driven by excess savings.

Today, more important than physical capital for growth is technological progress which is why government investment in R&D is so important-as the market doesn't provide an adequate amount do to the freeloader problem and spillover effects.

http://www.amazon.com/Supply-Side-Follies-Conservative-Economics-Innovation/dp/0742551067/ref=sr_1_sc_1?s=books&ie=UTF8&qid=1377632410&sr=1-1-spell&keywords=supply+side+follies+atkisnson

The trouble I always ahboe with ss arguments is that there is never any proof offered that they're in anyway the problem. When you ask SSers how come there's nor proof they say 'it's impossible to prove but it's real.'

P.S. By the way, regarding the interesting discussion on potential growth, there is also an interesting discussion going on about whether the short run-long run distinction has any justification at least among some.

http://bilbo.economicoutlook.net/blog/?p=25027#more-25027

Bill Mitchell argues it's mostly due to the false Neoclassical doctrine of long run monetary neutrality.

http://bilbo.economicoutlook.net/blog/?p=12473

P.S.S. I've been in something of a slump here at Diary-as this is the first post I've written since 8/25. For me that's something of a slump anyway. My new schedule where I work 8;30 to 1:30 in Melville-Long Island, New York-and then work in Lindenhurst doing my new job in calling people about refinancing their mortgages is kind of a lot I guess. Still, I vow to maintain my prolific posting here at Diary 'over the long run' to use an idea ta may be spurious in a way that definitely is.

"Brad DeLong has this habit where he makes it look as if he’s walked through several different strands of evidence, and they all come down squarely on the position he agreed with at the start of his investigation–even though some of the evidence obviously cuts the other way. It’s like we’re arguing over whether the Beatles ever released goofy songs, and he says, “I have considered John, Paul, George, and Ringo, and see no reason to support your wild accusation.”

http://consultingbyrpm.com/blog/2013/08/delong-sees-nothing-in-the-investment-data-that-would-slow-capacity-growth.html

From the start this analogy underscores the whole problem with Murphy. The question of whether the Beatles every did any goofy songs is a matter of opinion anyway-bringing up is kind of besides the point. One problem with many of Murphy's quibbles is that they're so often of the 'C'mon, of course the Beatles released goofy songs' nature. The answer is totally subjective and the question isn't too important.

Asking such questions is part of Murphy's stock and trade-no quibble is too minor. Presumably Krugman and Delong can take this as a compliment-after all, if he had anything on them he'd lead with that.

But the most egregious claim above is that there’s nothing “in the level of investment…to suggest that the path of growth of U.S. sustainable potential GDP is materially lower today than was believed back in 2007.”

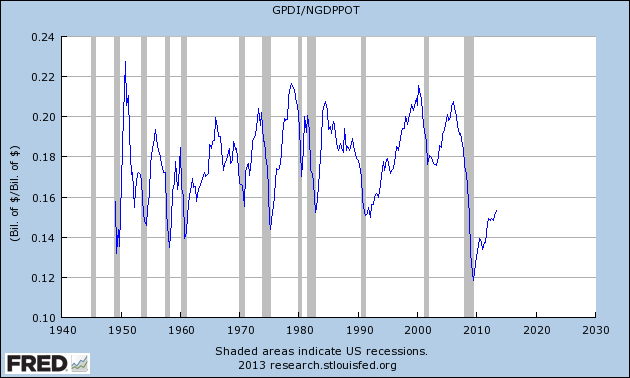

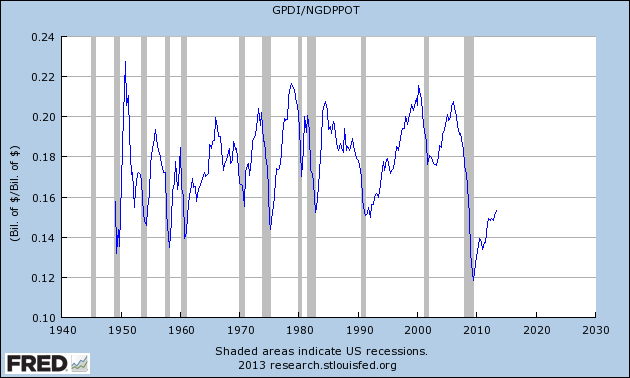

Oh really? Here’s the official government statistics showing gross private domestic investment as a percentage of potential GDP. To keep potential GDP chugging along at its previous pace, you’d think GPDI should stay about the same percentage as it was from 2005-2007. But this is what actually happened:

"Incidentally, I’m not purposely loading the deck against DeLong by only including private domestic investment; FRED doesn’t seem to have a single series adding government and private investment spending. But, I hardly think DeLong is able to claim that the above chart is more than offset by the huge surge in government investment spending (at federal, state, and local levels) from 2008 – present, what with the Republicans’ vicious austerity and all."

"So not only are the Austrians (and Larry Summers in the occasional op ed) the only ones who think thecomposition of investment spending is important for sustainable growth, but apparently we’re the only ones who think going from 23% down to 15% of total potential devoted to investment, might slow down the growth of potential output."

Ok, he's not 'purposefully stacking the deck' it's just that FRED didn't have a series that added government spending to private spending. Yet, isn't it stacking the deck a little regardless whether he or FRED chose not include the governemntdata?

Delong fires back:

"Does Murphy note, anywhere, that business equipment investment, which ought to fall as capital lifetimes are extended if the pace of trend economic growth markedly slows, has not?

"No."

"Does Murphy note that the shortfall in residential construction investment has a financial explanation and is not credibly blamed on a lower future potential output growth path?"

"No."

"Does Murphy note, anywhere, that at a 5% real rate of return on capital the reduction in potential as a result of the post-2008 investment shortfall is now (19%-14% fall in investment share) x 4 years x 5%/year return on capital = 1% reduction in potential GDP, which is why I said that the path of growth is not "materially lower" rather than not lower when you compare it to the 5.5% real aggregate demand shortfall relative to trend?

"No."

"There is an ongoing (and interesting, and insightful) academic discussion of potential GDP and its growth going on. But does Murphy participate in it at all, or recognize its existence?"

"No."

"Tell me how I am to interpret this other than as: "Oh. It's Murphy not doing his homework yet again"?

http://delong.typepad.com/sdj/2013/08/any-explanation-for-this-other-than-that-robert-murphy-simply-doesnt-do-his-homework.html

Krugman gets in a good whack at Murphy too:

"But it’s actually much worse than even Brad seems to realize. The potential output series he’s using comes from the Congressional Budget Office, whichdescribes its method (pdf):

CBO’s estimate of potential output is based on the framework of a textbook model of long-term economic growth, the Solow growth model. The model attributes the growth of real GDP to the growth of labor (hours worked), capital (an index of capital services emanating from the stock of productive assets), and technological progress (total factor productivity). CBO estimates trends —that is, removes the cyclical changes—in the labor and productivity components by using a variant of a relationship known as Okun’s law. (In principle, other “detrending” methods could be used to extract the trends in those inputs.)

"So the CBO already takes into account the effect of a smaller capital stock on potential output. That’s part of the reason CBO’s projections of future potential have in fact been marked down since the crisis began."

http://krugman.blogs.nytimes.com/2013/08/26/news-flash-the-cbo-isnt-stupid/?_r=0

More generally, it seems to me that the argument 'the supply side did it' in explaining this long recession is another case of the futility of supply side arguments in this day and age With how much conservative economists like Murphy and the Republican party spend worrying over the supply side which is always on the verge of contraction according to them, what isn't realized is how much ss theory is a 19th century idea of how the economy grows.

The idea that there is not enough physical capital is very 19th century, recalling a time when the railroads was America's main industry. In that time, the idea that we are constrained by a lack of physical capital least seemed highly plausible. By the end of the century, there was a glut in savings which exploded in the first big U.S. corporate merger wave.

The rise of the modern stock market was due to the fact that there was now a lot more money than than just that needed for investment in physical capital. This was the dawn of the modern financial system and it was driven by excess savings.

Today, more important than physical capital for growth is technological progress which is why government investment in R&D is so important-as the market doesn't provide an adequate amount do to the freeloader problem and spillover effects.

http://www.amazon.com/Supply-Side-Follies-Conservative-Economics-Innovation/dp/0742551067/ref=sr_1_sc_1?s=books&ie=UTF8&qid=1377632410&sr=1-1-spell&keywords=supply+side+follies+atkisnson

The trouble I always ahboe with ss arguments is that there is never any proof offered that they're in anyway the problem. When you ask SSers how come there's nor proof they say 'it's impossible to prove but it's real.'

P.S. By the way, regarding the interesting discussion on potential growth, there is also an interesting discussion going on about whether the short run-long run distinction has any justification at least among some.

http://bilbo.economicoutlook.net/blog/?p=25027#more-25027

Bill Mitchell argues it's mostly due to the false Neoclassical doctrine of long run monetary neutrality.

http://bilbo.economicoutlook.net/blog/?p=12473

P.S.S. I've been in something of a slump here at Diary-as this is the first post I've written since 8/25. For me that's something of a slump anyway. My new schedule where I work 8;30 to 1:30 in Melville-Long Island, New York-and then work in Lindenhurst doing my new job in calling people about refinancing their mortgages is kind of a lot I guess. Still, I vow to maintain my prolific posting here at Diary 'over the long run' to use an idea ta may be spurious in a way that definitely is.

No comments:

Post a Comment